Rejuvenation Science supplements are federal tax deductible and HSA reimbursable pursuant to IRS Publication 502, Medical and Dental Expenses. For states following the federal tax guidelines for itemized expenses, supplements are deductible there also.

Most functional, regenerative, integrative or anti-aging practitioners recommend nutritional supplements by brand because they understand the benefits of quality preventive medical care and the value of using supplements that are identical to what was used in the published studies they have reviewed. Patients benefit with Rejuvenation Science supplements by following your practitioners advice with tax deductions totaling 20% - 74% of the supplement cost. It may be cheaper in the long run to maintain your health, but it is almost always a better value to use quality products to do so. We have designed our "Supplement Prescription Form" which we provide to our practitioner partners to document for you the IRS requirements for tax deductibility.

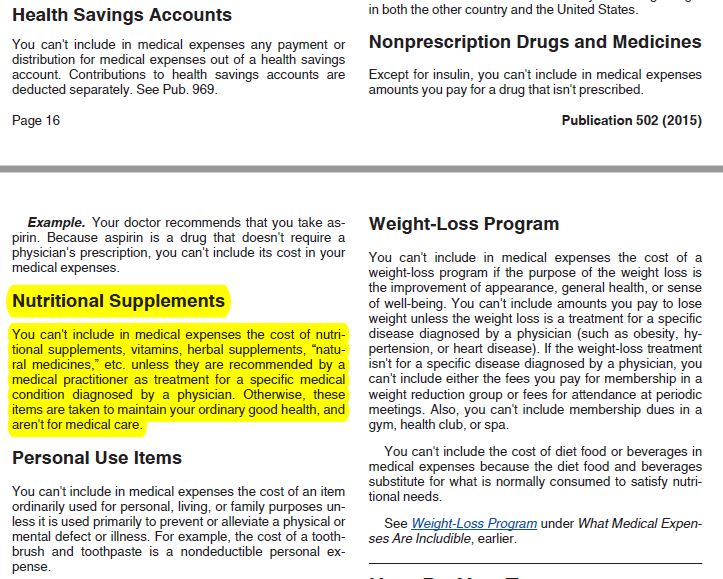

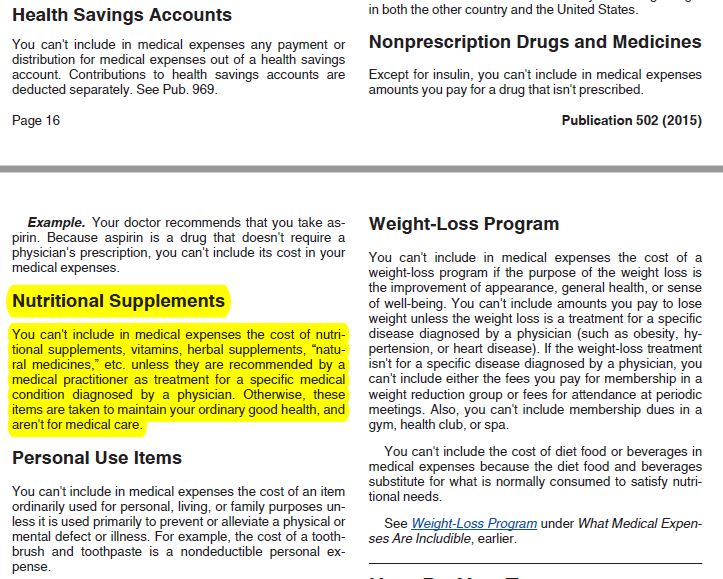

The following conditions are required for the supplements to be tax deductible or HSA reimbursable:

- Recommended by a medical practitioner;

- As treatment for a specific medical condition diagnosed by a physician.

Potential Savings are Huge

Itemizing Medical Expenses

For a moderate income family who have sufficient medical expenses to include them on Schedule A, Itemized Deductions:

- An income tax reduction of 20% - 30% of the amount paid for the nutritional supplements.

HSA

For a moderate to high income family who uses their HSA account for reimbursement of the amount they pay for nutritional supplements:

- An income tax reduction of 27% - 64.3% of the amount paid for the supplements, which includes 20-39% federal income tax savings, a 0-10% reduction in State income taxes, a reduction in Social Security and Medicare tax of 7.65% for employees or 15.3% if self employed. To receive the HSA deduction, a taxpayer does NOT have to be eligible to itemize medical expenses.

Sales Tax

For anyone in California or other states with special sales tax regulations:

- Save state sales tax of 0 - 10%. Some states exempt nutritional supplements from sales tax when prescribed by a medical practioner for a medical condition, saving an additional 0 - 10% in sales taxes. California is one of those states.

Please check with your tax preparer regarding your personal tax situation. Here is an excerpt from IRS Pub 502, 2015 version, page 17. To review the most current IRS regulations, search for Publication 502 Medical and Dental Expenses on the internet.